Real estate firm JLL has predicted that new development supply in the Central London residential market will continue to slow as a result of significant changes made recently by Government.

Neil Chegwidden, Director of Residential Research at JLL, said: : “Whilst the number of units under construction in Central London continued to climb during 2015 – with a 28 percent increase in the last year and 10 percent growth in H2 2015 – there are signs this is activity is beginning to plateau.

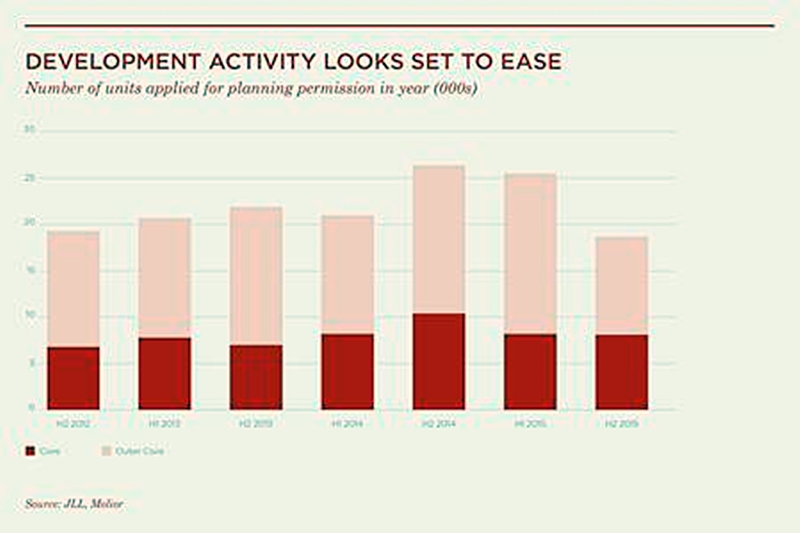

“The number of new unit starts in H2 2015 was lower than in H1, suggesting developers are beginning to slow their rate of delivery. Furthermore, and perhaps most significantly, the number of units seeking planning permission declined by 27 percent during the second half of last year compared with H1 2015, suggesting that developers are set to slow future development rates. This looks worrying at a time when new housing delivery needs to increase rather than fall.”

However, this has clearly been a reaction by developers to the recent political uncertainty, higher tax regime and slower sales market. The sales market had already been easing prior to the Autumn Statement in November, announcing that investors and second home buyers will have to pay an additional 3 percent stamp duty on purchases from April 2016, but this has further dampened London residential demand.

Price movements across London have been mixed over the last year and during Q1 2016, and whilst values have increased by 0.2 percent during Q1 2016 across Central London as a whole, this masks a 0.3 percent fall in Core markets and a 0.7 percent increase in Outer Core markets.

Broadly speakin lower value and Outer Core submarkets have experienced stronger price growth compared with higher value Core locations. The East continues to demonstrate the strongest price growth, seeing 7.0 percent in the year to Q1 2016 while the more expensive central submarkets, such as Central West and the West End, have experienced average price falls of 5.3 percent and 2.9 percent respectively.

Developers are experiencing varying degrees of success with their schemes, directly related to location and price point but broadly speaking. Developments in Outer Core submarkets are still selling well, with pricing usually in the £400 to £800 per sq ft range, as too are the lower-priced units in the less expensive Core markets, especially where developers are open to negotiation.

Chegwidden concluded: “Market conditions are highly location dependent – Outer Core markets where pricing is lower and buyers are largely domestic owner-occupiers will continue to perform well; markets more reliant on investor demand are proving more sensitive with developers and buyers jockeying for position.

“The EU Referendum is exerting additional uncertainty and the outcome of this in June will be a key factor as to how this market performs in the latter half of 2016.

“If the UK elects to exit the EU, a period of conjecture and debate will ensue. The upshot for the Central London residential development market will not necessarily be weaker in the long-term but it will undoubtedly mean reduced activity and pricing in the short-term with a less certain medium-term prognosis.

“However if the vote is to stay in, normal service will resume almost immediately. This still means that location, pricing and stamp duty effects will be key determinants, but we expect that a sound, safe and highly sought after London residential market will re-emerge once the dust settles and the market has adjusted to the new tax regime.”