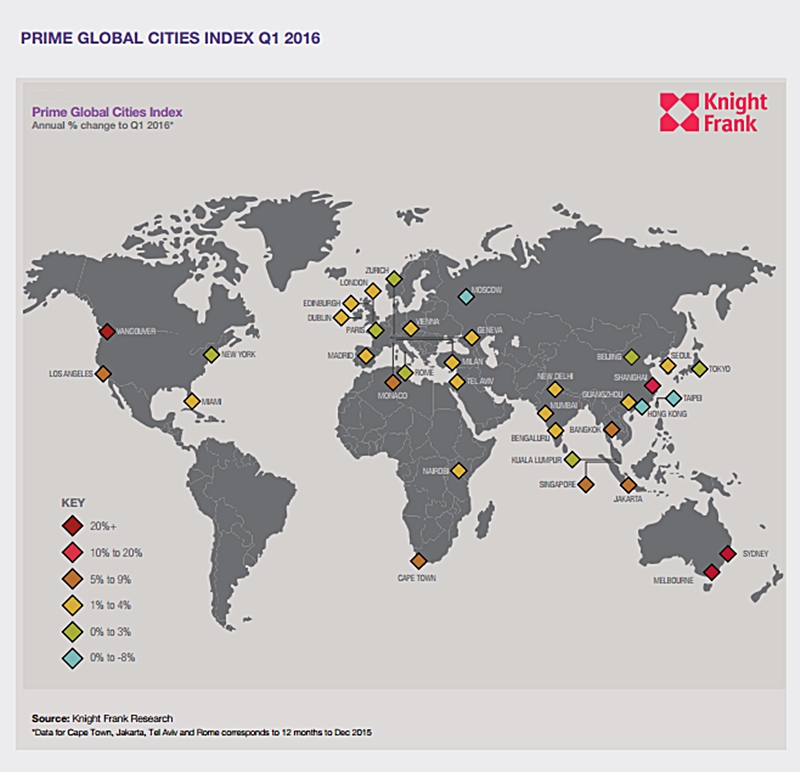

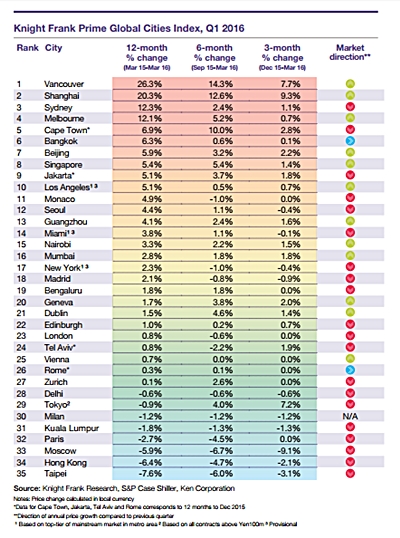

Prices of prime residential properties in Asian cities continued to perform well during the first three months of this year according to the latest Prime Cities Global Index report, published by real estate firm Knight Frank.

Vancouver topped the rankings for the fourth consecutive quarter, with prime prices in the city increasing by 26 percent in the year to March 2016. A severe lack of supply is creating an upward pressure on prices. There is little evidence that February’s increase in land transfer tax, from 2 percent to 3 percent, on all purchases above CAD$ 2 million, has dented sale volumes.

Along with Vancouver, three other cities; Shanghai, Sydney and Melbourne, also recorded double-digit annual price growth, but the gap between this top tier and the remaining cities has widened.

Along with Vancouver, three other cities; Shanghai, Sydney and Melbourne, also recorded double-digit annual price growth, but the gap between this top tier and the remaining cities has widened.

Record-low interest rates and cheap finance-fuelled demand in Shanghai lead to price growth of 20 percent year-on-year, however, in March the Government tightened mortgage lending rules which is likely to result in slower growth in the second quarter.

Australasia proved the world’s hottest world region in the year to March 2016 with prices rising 12 percent on average; this is despite the introduction of a new fee for foreign buyers.

Prime prices across the 35 cities monitored by the firm increased on average by 3.6 percent in the 12 months to March 2016. The Index entered a period of steady growth in 2014, consistently recording annual growth of 3-4 percent in the subsequent seven quarters.

No city has recorded a double-digit annual decline in prices since Q2 2015.

New York and Miami, where cash buyers now have to comply with new transparency rules above set price thresholds, continue to record steady price growth.

Prices in prime central London increased by only 0.8 percent in the year to March, its lowest figure since October 2009, when a 3.2 percent decline was recorded as the market readjusted following the collapse of Lehman Brothers. The more muted performance is as a result of a series of tax changes and a preceding period of exceptional growth.

As of 1 April 2016, buy-to-let investors and second-home buyers pay an extra three percentage points of stamp duty on any U.K. purchase.

Although prices in Paris dipped 3 percent in annual terms, prices stabilised over the last quarter as French buyers, having recognised value in their capital’s market, increased their market share.

New regulation in the form of measures to improve transparency, new taxes or fees for foreign buyers are increasing in number. However, the impact on the market of such measures is largely dependent on market fundamentals and where each market is in relation to its property market cycle.